The #1 investing in gold and silver Mistake, Plus 7 More Lessons

Gold IRA Physical Possession: The Pros and Cons

Noble Gold has also received hundreds of five star reviews from satisfied customers, allowing you to feel confident in its practices. The team will work hard to gain your trust while you diversify your portfolio. Noble Gold specializes in helping investors convert their traditional IRAs into self directed IRAs that allow for greater flexibility in investment options. It would be best to clarify this by calling different companies. When gold is sold, it’s taxed, just like other investments. Goldco Precious Metals was founded in 2006 and quickly established themselves as a prominent player in the precious metals industry. In all, economic uncertainty is making metals more attractive to invest in more than ever, with the price inevitable to rise in the future. Gold bullion is used as a reserve currency for many governments. Protect Your Wealth and Secure Your Future with Patriot Gold Club’s Top Tier Precious Metals IRA Custodianship. Noble Gold assigns a dedicated account manager to you right from the get go. We pride ourselves on making precious metals investments quick, painless and easy to manage. Lear Capital is a trusted name in the industry, with over 25 years of experience. The company has earned investors’ trust through its professionalism, transparency, and customer service.

How do you choose the best gold IRA companies?

For instance, if you invest more than $50,000 into your new gold IRA, the company will waive all your first year fees, including account management and setup fees. Additionally, it is important to research the fees associated with the custodian or broker. The company also understands that not every investor wants to purchase gold and silver, which is why it also offers reliable storage options that allow investors to store their investments safely. This is often included in storage fees, investing in a gold ira raising the yearly average to around $300. These entities can treat the precious metals as a single, shared fund or detail individual assets. American Bullion and its agents are not registered or licensed by any government agencies, and are not financial advisors or tax advisors. Look for a custodian that is insured and has a strong reputation in the industry. This conference provides valuable insights into the world of precious metals investing.

Software and Business

However, by following these guidelines, you can ensure that you have enough gold and silver iras to secure your financial future. No online order tracking. The user access, the use of the website as well as this general legal information are subject to Liechtenstein law. Experience the Best of GoldCo: Try Now and See the Difference. These situations often force people to decrease prices drastically meaning a lot of excess cash will be floating around. Overall, Advantage Gold is an excellent choice for investors seeking security, transparency, and long term growth. First, complete an online form to receive the company’s free investor’s kit or open your account. There are many important things to take into consideration when choosing the right gold IRA company. Investors should only go down this road with their eyes wide open. This informative web conference will give you all the necessary information to make a sound decision. Unlike past years, nobody is suffering from a lack of information about investing. Below is an interactive chart on precious metals spot prices going back 10 years. In fact, we found very few complaints online for the firm.

Investing in gold can be a smart way to diversify your portfolio, reduce your overall risk, and protect your wealth in the long run Here are the best gold IRA companies in the USA

Palladium IRA Account: Interest Rate of 3. Best for great customer support and educational resources. The second factor is weight, which gets measured in Troy ounces. Buy gold or silver: Once your rollover is complete, you can choose the gold or silver to include in your IRA through Augusta’s order desk. You shouldn’t face any tax penalties when transferring funds from one custodian to another. Best Gold IRA Companies. We actively monitor the industry and our independent editorial team regularly updates this list.

List of The Top 10 Best Gold IRA Companies of 2023

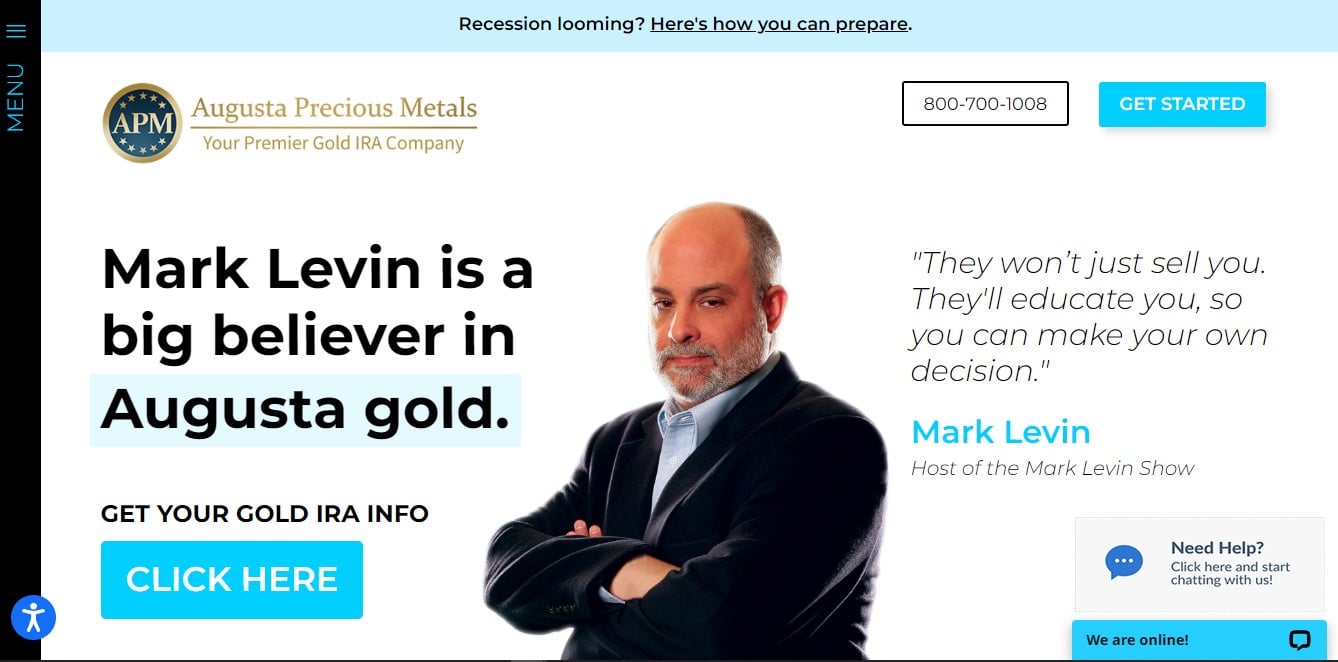

On the other hand, if you’re looking for potential growth, silver may be a better option since it’s less expensive than gold and has more industrial applications. Augusta Precious Metals. They offer quality products and services backed by knowledgeable and experienced professionals, ensuring clients receive the best advice and support. Gold is a go to choice during periods of political or economic turmoil and as a safeguard against rising inflation. Gold IRAs are a specific type of self directed IRA that allows you to invest in physical gold and other precious metals like silver, platinum and palladium. Experience the Brilliance of GoldCo. For instance, an IRA holder must take distributions by April 1, 2022, if they turn 72 years in the previous year. Silver is the leading metal with hopes of shining and rising in 2023. Liquidity: Gold is highly liquid, meaning you can easily convert it into cash when needed. It’s a proven way to grow your investments. A Gold IRA Rollover is a type of retirement account that allows individuals to store their retirement funds in gold, silver, platinum, and palladium. APMEX can help you get the most from your Precious Metals IRA.

Finding A Broker Or Custodian For Your Gold Based IRA

This makes it a clever addition to investment portfolios like IRAs. Discover the Benefits of Investing in Noble Gold and Secure Your Future Today. One reason American Hartford Gold remains among the leading gold IRA company in the country is their valuable and unique service to their clients. Specifically, the gold, platinum, and palladium in these accounts must be at least 99. Also, consider consulting your accountant or financial advisor before making any investment to ensure it aligns with your portfolio plan. In 2023, traditional retirement accounts are steadily losing value while gold and silver are still as reliable as they have been for centuries. 45 goes to the gold IRA firm. 8/5 Stars From 253 Reviews. Advertising Disclosure. Augusta is so confident of its pricing that the company encourages investors to compare their prices with other dealers. By diversifying your portfolio with a gold IRA, you can protect yourself from the ups and downs of the stock market.

GoldBroker: Summary Best Gold IRA Companies

Using a traditional IRA and storing Gold at a depository is much safer. You can do this by researching online or asking for referrals from family and friends. A Gold IRA is an Individual Retirement Account that allows investors to hold physical gold, silver, platinum, and palladium coins in their retirement savings. They also provide timely and accurate information on the current gold market, giving investors the opportunity to make informed decisions. On top of these basic fees, IRA providers can choose whether to charge a commission for buying gold for their clients. When comparing these companies, it’s important to consider factors such as fees, customer service, and reputation in the industry.

Find where to watch the Scripps National Spelling Bee May 31 and June 1 on ION!

Goldco: Best gold ira company and most trusted. They must be stored by the IRA custodian in an IRS approved depository. As you diversify your portfolio, the team will work diligently to gain your trust as well. For one, investors often pay a premium over the metal spot price on gold and silver coins because of manufacturing and distribution markups. Gold as an IRA investment can also create security and stability in the case of an economic downturn. Augusta Precious Metals also offers a wide range of other investment products, such as silver and platinum IRA products. These aren’t serious red flags that should make you run for the hills but they might make Noble Gold Investments the wrong choice for you.

Is it safe to use a gold backed IRA?

So take advantage of that knowledge to learn as much as you can, or do some of your own research on precious metal IRA offerings. As of March 18, 2021, gold’s current value is about $1,736 an ounce. With Birch Gold, customers can rest assured that their gold IRA rollover is in the best hands. And uses state of the art surveillance systems and tight security personnel to ensure the safety of your assets. With Noble Gold, the process of carrying over an IRA for gold, silver as well as other precious metals is straightforward. It is important to work with reputable Gold IRA companies when considering investing into Gold IRAs. By the time you’re done reading, you’ll have a much better idea of what gold investment companies are best suited to your needs. Investing in gold and other precious metals can serve as a valuable safeguard against inflation, offering protection in times of market uncertainty and economic instability. Gold IRA companies can provide loans against gold investments to help individuals overcome financial situations. It puts the clients’ interests first and provides education on all matters before one invests. The company also provides real time gold price data, historical gold performance and annual performance charts and a precious metals spot price table. Conversely, a precious metals IRA is a retirement account that is funded with physical gold, silver, platinum, or palladium. With a traditional IRA, you cannot use precious metals.

The Debt Domino Effect: How Declining Bank Reserves Influence the Debt Ceiling Crisis

Protect Your Retirement Savings with GoldCo The Trusted Gold IRA Company. The company buys and sells precious metals and coins for their intrinsic value, allowing investors to buy or sell whatever they want. Gold Alliance is known for client satisfaction. Historical trends show that investing in gold has made a good if imperfect hedge against poor performance from currencies, shares, bonds and real estate. With the help of one of the best gold IRA companies, you can ensure the process is completed correctly and efficiently. While it may have a steep minimum investment, the services provided by the company make it a great choice if you value transparency and learning while you invest. After funding your account, you decide which precious metals to buy and how much of each. We now prefer private over public credit long term. This step is crucial for individuals who are new to investing or have no prior knowledge of precious metals IRAs. The founder of Noble Gold Investments has many connections within the gold and precious metals industry, allowing the company to offer competitive pricing on gold, silver, platinum, and palladium from across the world. But be aware that you will be taxed accordingly and be responsible for any liability to the IRS for early withdrawals. When you click on the “Apply Now” button you can review the terms and conditions on the card issuer’s website. Disclaimer: This material is partially funded by a sponsor. Gold and Silver IRA Account – 0.

Cons

The first factor to consider when comparing gold IRA companies is fees. Limited educational resources. Among the newer gold IRA companies. That being said, you still won’t be able to store gold at home. You can’t take actual possession of your gold, or it will be treated as a withdrawal under IRS rules and may be subject to penalties. You can also invest in bullion coins and private companies. According to recent research, the top gold and silver IRA companies offer their clients competitive pricing, excellent customer support, and reliable information. Noble Gold’s commitment to providing excellent customer service and consistent support make it a top choice for gold IRA rollover investments. Choosing the best gold IRA plan might be difficult for many gold investors, but we are here to help.

29 31 August 2023

Consult a professional investment advisor to get an understanding of what amount of Gold diversification would work best for you. Wide range of product selection. And, by extension, making it impossible to know how much gold would need to appreciate for their actual investment to be profitable. Other fees you should know of are:• An custodial maintenance fee of $80• An depository storage fee of $100. The timescales for open a Goldco Precious Metals IRA are very much case by case, but it may not take longer than 3 weeks. Main Office100 Concourse ParkwaySuite 170Birmingham, AL 35244205 985 0860. Their knowledgeable staff provides expert advice and guidance on how to maximize the potential of gold backed investments.

Welcome Bonus

Secure Your Retirement with Advantage Gold: The Trusted Precious Metals IRA Company. This is where gold IRA reviews can be helpful. Gold, platinum, and palladium must be 99. Patriot Gold Group: Best selection of precious metals. It can provide its clients with valuable information about their safety and security while helping them achieve their financial goals. The company’s website makes it easy for clients to do research and learn more about investing in precious metals. To open a gold IRA, you must work with a legitimate gold IRA company to store your IRA assets in an IRS approved depository. You should also consider the quality and fineness of gold when investing with a precious metals IRA company.

Choose Your Investment

What are the tax benefits of purchasing Gold through an IRA. 2 How to Invest in Gold or Silver. At Noble Gold Investments, we protect your financial future by offering a secure and convenient way to invest in physical precious metals, rare coins, or a gold and silver IRA. Of the many precious metals IRA companies featured regularly in various review platforms, such as Business Consumer Alliance and Better Business Bureau, we have come up with three names that we are certain will provide you with the most reliable Gold IRA services. Though the company does not have the lowest rates, theirs are among the most competitive in the Gold IRA market. Look for the facility closest to you that best meets your needs/budget. Gold IRA custodians can help investors to understand the rules and regulations associated with gold IRAs and provide guidance on the types of gold investments that are allowed. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL, Tel: +44 020 7743 3000. They offer personalized advice, a secure, user friendly platform, and a secure storage facility. The gold IRA company will provide step by step instructions to help clients complete the process safely and efficiently. They stand out for their expertise in the gold IRA industry, providing customers with reliable and secure investments. => Visit Oxford Gold Group Website. Customers pay two annual fees: An $80 account fee and a $150 fee for insurance and segregated storage, in which customers’ holdings are stored individually rather than pooled together. Furthermore, the team conducted extensive research to identify the best gold IRA companies and compiled the findings in a comprehensive report.

Ready to Protect Your Retirement Savings?

Essentially, when investors notice that the value of their currency is experiencing volatility, they look to sound money, such as physical gold. Some tips for finding a custodian include. We find it a little weird, considering this simply means gold is flat and trailing stocks since its last peak in August 2020, but you wouldn’t know that from the nonstop marketing campaigns. And yet they’ve managed to quickly rise to the top of the ranks when it comes to gold IRAs. Remember that not all gold and silver pieces may be utilized in an IRA due to certain IRS regulations. Free rapid delivery if you invest $25,000 – applies to investors who want to own physical precious metals. ☑️ Highest Ranked Precious Metals Company on 2022 INC 5000 List. They are also responsible for ensuring that your investment meets IRS regulations and guidelines.

Philly Weekly Staff

Individual shares are specific investments that represent part ownership of a single company. Gold and other precious metals should make up a portion of your investment portfolio to protect yourself against potential losses if the global economy experiences a calamity. The IRS has a list of storage facilities that can handle IRA gold. Unlike traditional retirement accounts that only hold paper assets, a gold IRA is backed by precious metals such as physical gold and silver. Management fees: Varies. Discover the Benefits of Investing in Precious Metals with Birch Gold Today. When it comes to retirement planning, gold is often overlooked as a viable investment option.

Subscriptions

If you’re interested in retirement options, consider opening a gold IRA. And State Street Global Advisors, as of August 31, 2022. The company enjoys an A+ rating with the BBB and a perfect 5. Solid diversification option with a history of outshining traditional assets. Uncover the Benefits of Birch Gold Group. But within its short existence, the company has made significant strides, leaving people and us more impressed than businesses that came before it. Gold and silver have long been used as a store of value, and their prices tend to remain relatively stable over time. It’s received several positive reviews across multiple platforms. Additionally, it is important to make sure the company is registered with the Internal Revenue Service, as well as the Financial Industry Regulatory Authority. There are many ways to go about this, such as marketing gold products and services, promoting websites related to gold investments, and even creating a blog or website dedicated to investing in gold. Recent events have shown that nothing is predictable, and even the market’s best performing sectors are struggling. Always keep your details and IRA information to yourself. You have multiple options for funding a gold IRA, including cash, transfer, and rollover.

Learn More

When it comes to understanding and managing risk, and knowing the importance of diversification that can be had with a precious metals IRA, Red Rock Secured has been a solid choice for our readers. You won’t get any shortcuts or end arounds. The firm will usually assess a one time setup fee when you open up a gold IRA account. We apologize for the inconvenience. Gold IRA reviews are a great way to start researching the best broker or custodian for a gold based IRA. The one restriction that remains is that the IRA owner cannot have physical possession of the gold. The resources that stood out the most were the FAQs that provided clear answers to some common industry questions. Secure Your Retirement with Noble Gold’s Precious Metals IRA Investment Options. Review the 7 best gold IRA companies in this guide.